- Coinbase vs Gemini: Key Information

- Two Different Ways to Buy Cryptocurrencies

- Purchasing Limits

- Two Trusted Companies

- Safety of Funds

- Customer Support

- Available Cryptocurrencies

- Fees

- Coinbase vs Gemini: Which is better?

For newcomers looking to find a place to buy cryptocurrencies, like Bitcoin and Ethereum, there’s no shortage of options. Gemini and Coinbase are two of the most often recommended options and for good reason. In this “Coinbase vs Gemini” review, we’ll show you the differences between the two options, so that you can make an informed decision about which is best for you.

Covered in this comparison:

- Coinbase vs Gemini: Key Information

- Two Different Ways to Buy Cryptocurrencies

- Purchasing Limits

- Companies’ Trust

- Saftey of Funds

- Customer Support

- Available Cryptocurrencies

- Fees

- Final Thoughts

Coinbase vs Gemini: Key Information

| Reviews | ||

| Site Type | Easy Buy/Sell Methods | Cryptocurrency Exchange |

| Buy Methods | Credit Card, Debit Card, Bank Transfer | Bank Transfer |

| Sell Methods | PayPal, Bank Transfer | Bank Transfer |

| Available Cryptocurrencies | Bitcoin, Ethereum, Litecoin | Bitcoin, Ethereum |

| Company Launch | 2012 | 2015 |

| Location | California, USA | New York, USA |

| Community Trust | Great | Great |

| Security | Great | Great |

| Customer Support | Good | Good |

| Verification Required | Yes | Yes |

| Fees | Medium | Low |

| Site | Visit Coinbase |

Two Different Ways to Buy Cryptocurrencies

While both of these sites can be used to buy cryptocurrencies, they work differently.

Coinbase directly facilitates the sale of Bitcoin, Ethereum, and Litecoin to their users. When you buy cryptocurrency from their site, there is a set price at the time of your purchase. You can think of Coinbase as a “cryptocurrency retail store”.

Most other sites where users can buy cryptocurrency operate as an exchange. They work similarly to a forex or stock exchange.

Coinbase’s system of selling cryptocurrency comes with a few key advantages:

- Users can buy cryptocurrencies instantly with credit and debit cards after verifying their accounts. (See verification note below.)

- Users can immediately lock in their purchase price when buying cryptocurrencies with bank transfers, although these purchases require processing time.

To help illustrate these advantages, we’ll show you the steps for buying cryptocurrency on Coinbase, then show you the steps for buying cryptocurrency at traditional exchanges.

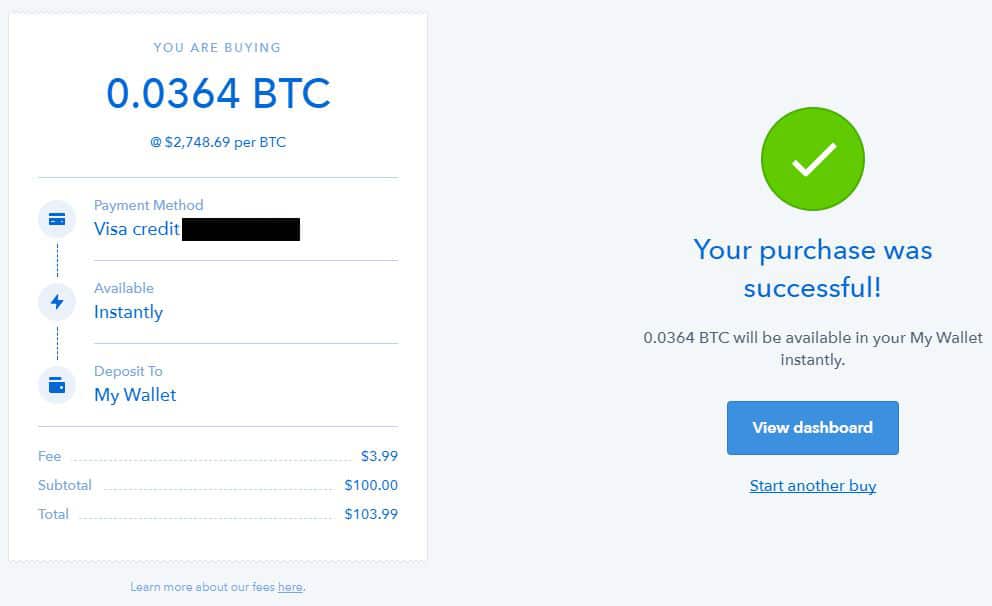

Buying Cryptocurrencies with a Credit Card on Coinbase

- Create and verify your account.

- Buy Bitcoin, Ethereum, and Litecoin at their set price and receive it instantly.

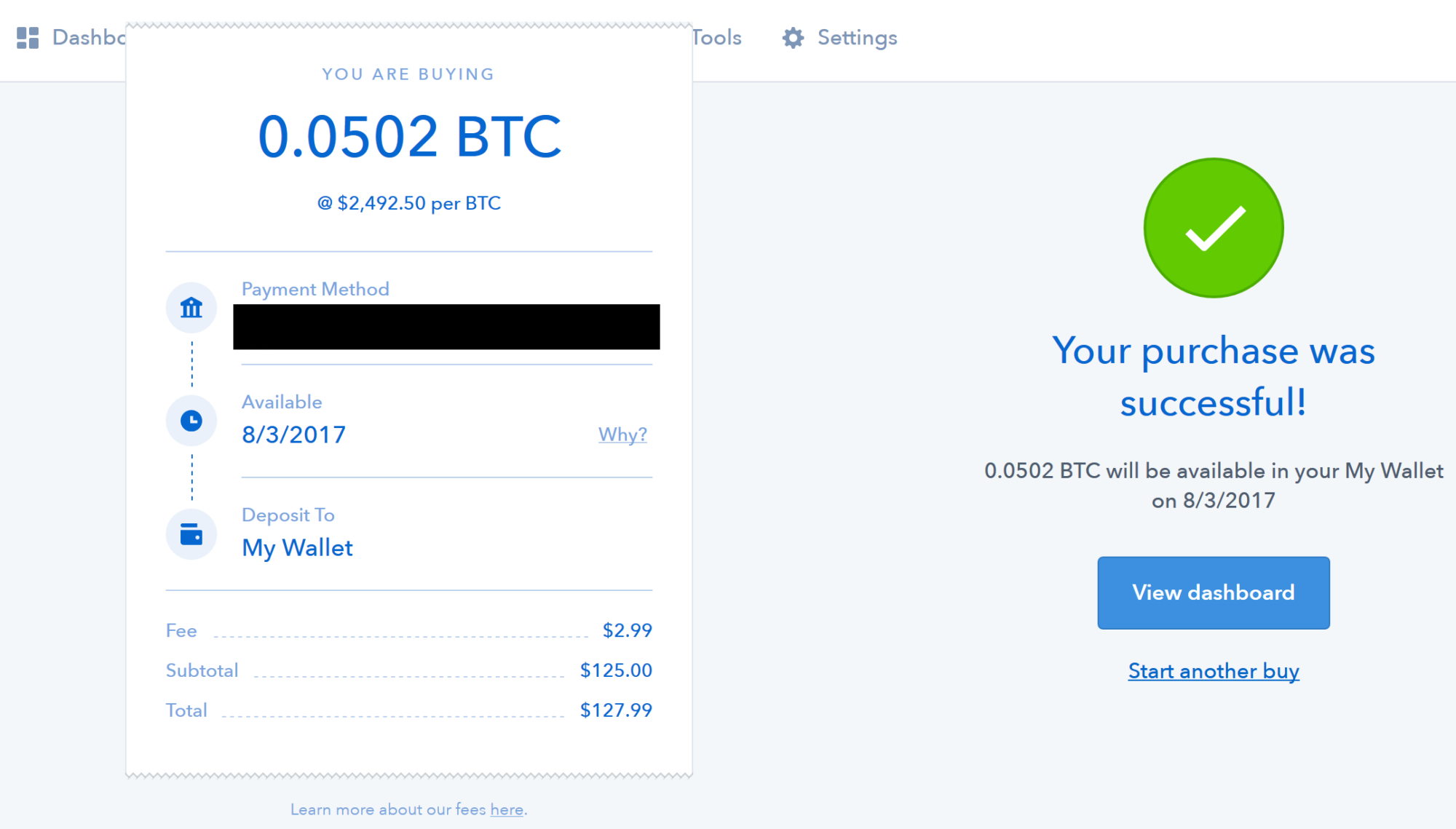

Buying Cryptocurrencies via Bank Transfers

- Create and verify your account.

- Buy Bitcoin, Ethereum, and Litecoin at their set price.

- You will receive the agreed upon amount of cryptocurrency that you purchased after a few days of processing time.

Buying Cryptocurrency from Most Traditional Cryptocurrency Exchanges

- Create and Verify Your Account.

- Deposit fiat currency to the exchange via bank transfer, which typically takes 1-5 business days.

- Place an order on the exchange’s market.

- When your order has filled, you receive your cryptocurrency.

As you can see, Coinbase can allow you to receive your cryptocurrency faster than traditional exchanges, when buying with credit cards. Coinbase also allows you to lock in your price immediately, unlikely traditional exchanges.

Gemini falls somewhere in the middle between traditional exchanges and Coinbase. While Gemini is a cryptocurrency exchange, they allow users to immediately trade for cryptocurrency when depositing via bank transfers. In other words, you can begin trading before your deposit is fully processed. However, you won’t be able to withdraw your cryptocurrency before your deposit is fully processed.

Buying Cryptocurrencies via Bank Transfers on Gemini

- Create and verify your account.

- Deposit fiat currency to the exchange, which will be instantly available for trading.

- Place an order on the exchange’s market.

- When your order has filled, you receive your cryptocurrency.

- You can withdraw your cryptocurrency once your bank transfer has been fully processed.

Like Coinbase’s bank transfer purchase option, this process allows you to lock in your price faster than on traditional exchanges.

*Verification – Reputable sites that allow users to buy cryptocurrencies in exchange for fiat currencies (USD, EUR, GBP, Etc.) require users to verify their identity. This is required to comply with laws and regulatory bodies where these companies operate. Keep in mind, similar verification would be required when creating a traditional stock brokerage account.

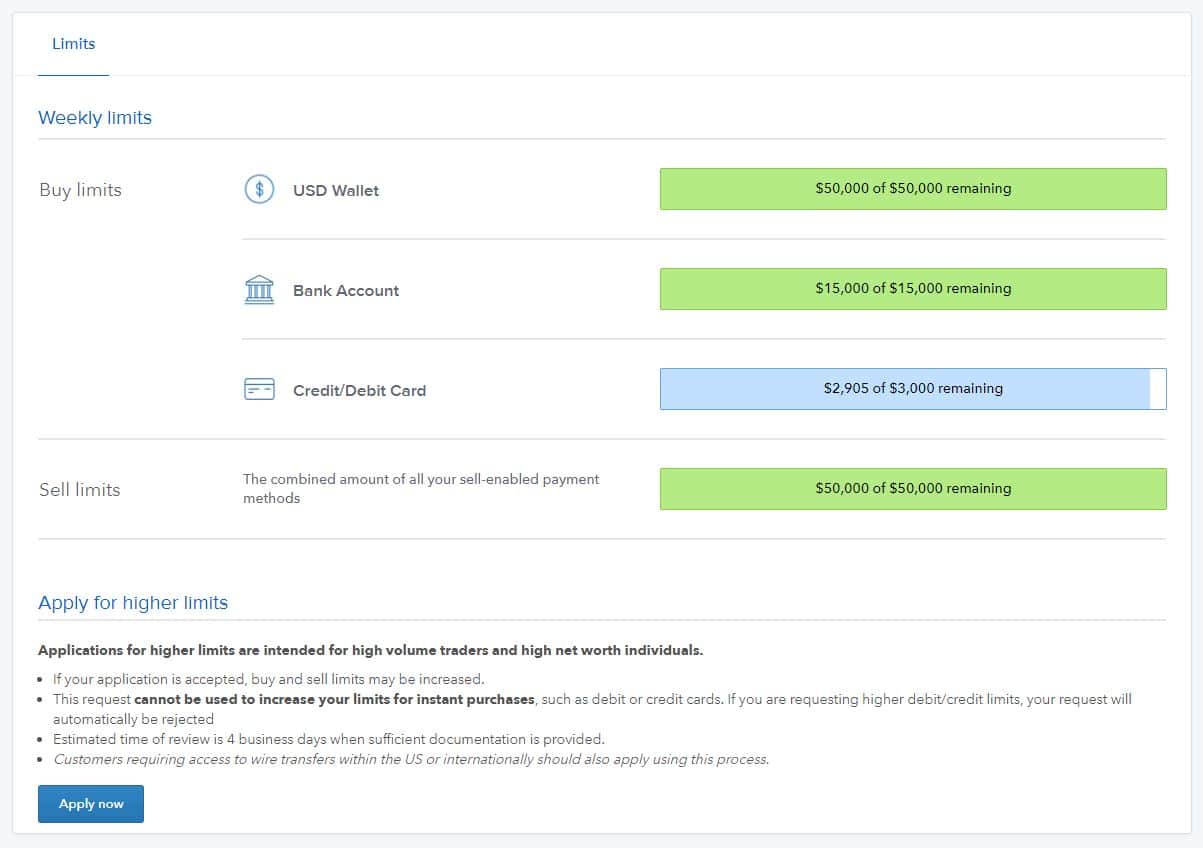

Purchasing Limits

Coinbase does not clearly define limits on its site for new users. Instead, limits can vary depending on account age, buying history, and account verification. Your personal limits will be shown on your account’s verification page.

In our personal experience, bank transfer limits were quickly set to $5,000 per week, while credit card limits were initially set to only $60 per week.

Gemini has predefined purchasing limits for bank transfers, of $500 per day.

If you’re looking to immediately lock in a price for more than $500, Coinbase will most likely provide you more limits.

Both sites offer wire transfers for users looking to deposit larger sums, although you may have to apply or contact them directly.

Two Trusted Companies

Both companies are based out of the U.S. and serve U.S. customers. This means both companies are regulated by various U.S. government and regulatory bodies.

Coinbase was launched in 2012. In this time, they have served over 8 million customers and helped to exchange over $20 billion of digital currency. They have also received investments from Alexis Ohanian (Reddit Co-Founder), Blockchain Capital, Bank of Tokyo, and various other trusted investors.

Gemini was launched in 2015 and was founded by Tyler and Cameron Winklevoss. While they haven’t been around as long as Coinbase, they’ve quickly built a great reputation in the community. They consistently have some of the largest daily Bitcoin trading volumes of all exchanges.

Safety of Funds

Both sites segregate customer funds from company operational funds. Additionally, both sites follow industry best practices for securing cryptocurrency funds. The majority of cryptocurrency funds are stored in secure offline cold storage wallets.

Customer Support

While customer support is an issue plaguing many cryptocurrency companies, Coinbase and Gemini both do a pretty good job in this department.

Coinbase customer support is handled through email. In our personal experience, we’ve always gotten responses within 24-48 hours. The majority of reports from online forums echo this, although 24-72 hours may be a more accurate time frame.

Gemini also handles its customer support through email. Response times seem to be very similar to Coinbase.

Available Cryptocurrencies

Coinbase allows users to buy and sell Bitcoin, Ethereum, and Litecoin.

Gemini only supports trading for Bitcoin and Ethereum.

Fees

If your goal is to save as much as possible on fees, Gemini is your best bet.

Gemini does not charge fees for deposits or withdrawals and only charges .25% or less fee for trading.

Coinbase charges around 1.49% for bank transfer purchases and 3.99% for credit/debit card purchases.

Coinbase vs Gemini: Which is better?

With both sites being trustworthy and secure, the battle of Coinbase vs Gemini comes down to your preferences and needs. Both give you about $10 for signing up with those links.

If you’re looking to quickly buy cryptocurrency or you want to use a credit card, Coinbase is the option for you.

If you want to save the most on fees, Gemini is the best option.

More Coinbase Comparisons

More Gemini Comparisons

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.